The Importance of Calculators in Cryptocurrency Investments

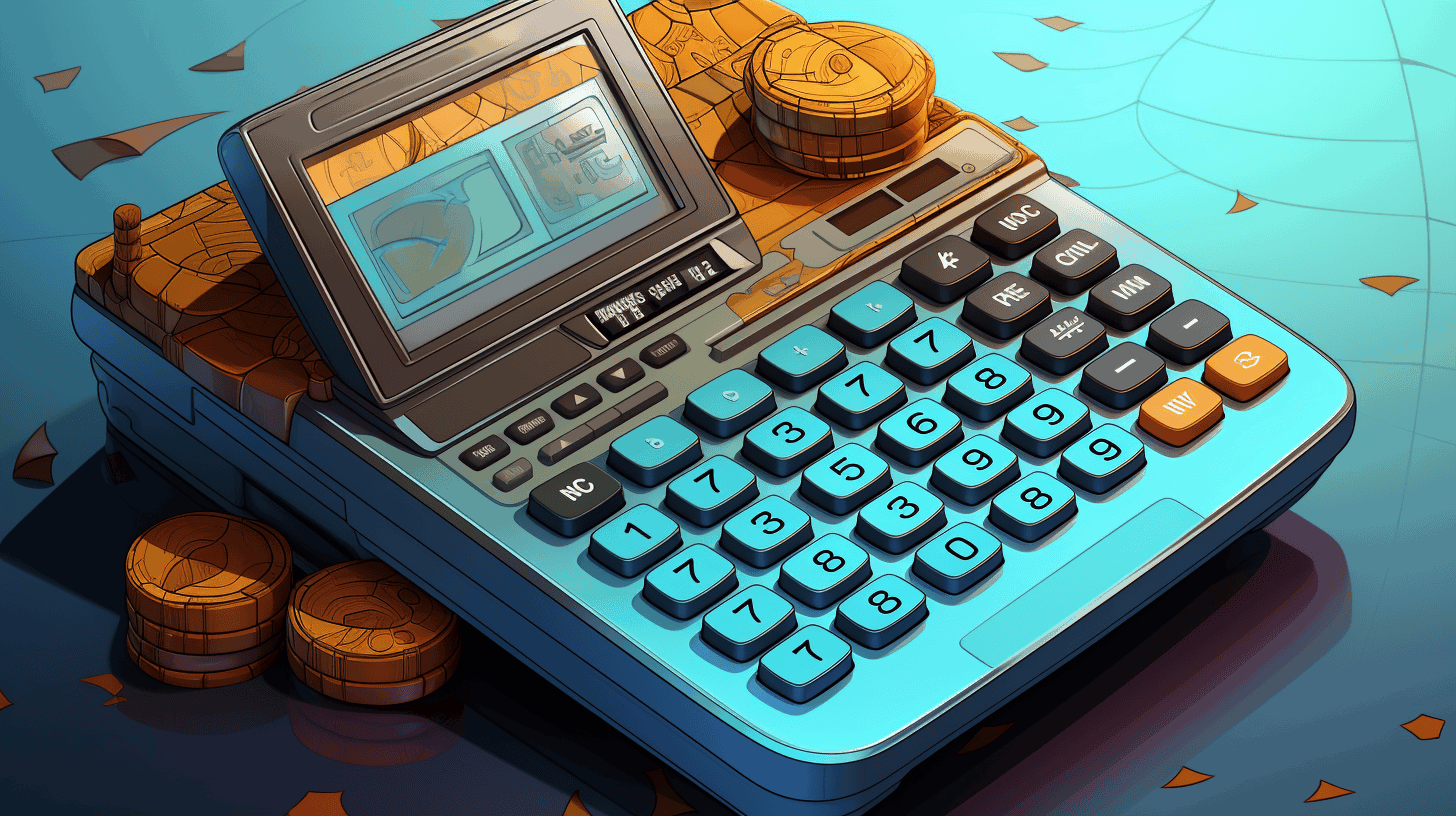

For investors aiming to maximize profits in the dynamic world of cryptocurrency, precision and informed decision-making are paramount. One tool that often goes unnoticed but plays a pivotal role in shaping profitable crypto investments is the humble calculator. But why is a calculator so crucial for crypto investors? Let’s delve into its importance.

Ensuring Accurate Profit and Loss Calculations

The value of cryptocurrencies can fluctuate significantly within short time frames. A calculator helps investors determine the real-time value of their holdings, ensuring they have a clear understanding of their portfolio's worth. By inputting historical data, investors can assess past performance, helping them understand trends and make informed future predictions.

Assisting in Tax Obligations

Many jurisdictions consider profits from crypto trading as capital gains. A calculator helps investors determine these gains accurately, ensuring they meet tax obligations without overpaying.

Consistent use of a calculator for every transaction aids in maintaining a meticulous record, which becomes invaluable during tax season or audits.

Facilitating Conversion

Price discrepancies between different exchanges can be capitalized on for profit. Calculators help investors quickly convert rates, identifying potential arbitrage opportunities.

Evaluating Staking and Mining Rewards

- Return on Investment (ROI) Analysis: Crypto stakers or miners need to weigh the potential rewards against the costs involved. Calculators assist in projecting rewards and comparing them against expenses like electricity costs for miners or staking fees, helping individuals ascertain the profitability of their efforts.

Compound Interest and Reinvestment Strategies

Many crypto platforms offer interest on holdings. Using a compound interest calculator, investors can project how their investments might grow over time with regular reinvestments, optimizing profitability.

Budgeting

A calculator helps investors allocate funds wisely, ensuring they do not overextend and risk too much capital in one asset or trade.

For those deeply involved in crypto, tracking expenses, whether they're transaction fees, withdrawal fees, or other costs, is crucial. Regularly using a calculator ensures that these expenses are accounted for and helps in maintaining a healthy profit margin.

Planning and Forecasting

For long-term holders, calculators can help model various scenarios based on historical growth rates and market predictions, aiding in investment strategy formulation. Day traders or swing traders can use calculators to set daily or weekly targets, ensuring they remain on track and aligned with their investment goals.

Conclusion

While the world of cryptocurrency is characterized by its digital nature, cutting-edge tech, and innovative solutions, it's often the simple tools that play an integral role in determining success. A calculator, with its precision and reliability, is one such tool that should be in every crypto investor's arsenal.

Whether you're a seasoned trader, a long-term holder, or someone venturing into the world of crypto, regularly using a calculator ensures you remain informed, make accurate financial decisions, and, most importantly, stay profitable. In an ecosystem driven by numbers, it's the tool that helps you crunch them right.

Disclaimer: Cryptocurrency investments are speculative and involve risks. This article is for informational purposes only and should not be considered financial advice. Always conduct your own research before making decisions.