Track Your Portfolio with the Staking View Tool

With our tool, you can create your own personalized portfolio. We're one of the few to offer you this option, and it's not to be overlooked. With Staking View’s tool you will be able to track your staking activities and monitor your earnings. You can track your staking in real time and adjust if needed. You can create more than one portfolio, according to your needs.

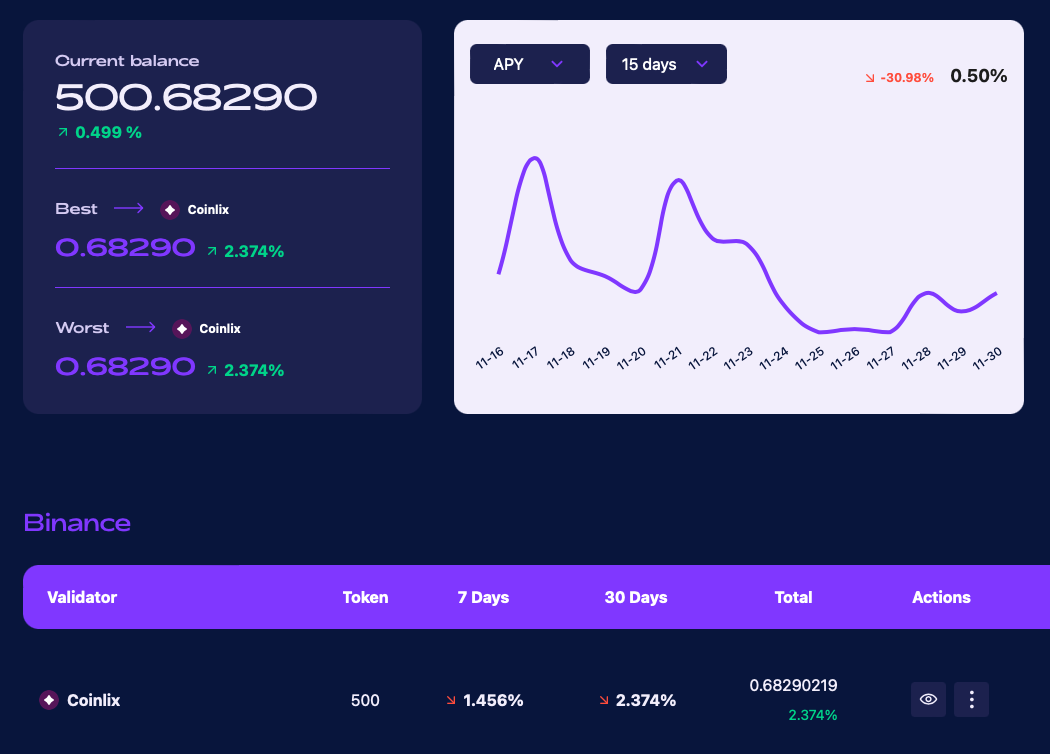

In the dynamic and ever-evolving world of cryptocurrency, the allure of quick returns can be intoxicating. But as any seasoned investor will tell you, placing all your bets on one horse is rarely a prudent strategy. Before diving in, equip yourself with knowledge. Understand the purpose, technology and vision behind any cryptocurrency you consider adding to your portfolio. Here an example of what a portfolio looks like:

You can see the changes for the last 15 days or 30 days.

Features of Our Tool

Our Staking View tracking tool gives you access to several features. These will enable you to keep track of your various portfolios, while ensuring smooth operation. Staking cryptocurrencies on multiple validators across various networks has become a common practice for those looking to optimize their returns and spread their risk. Tracking such staking activities can be complex and requires sophisticated tools and features. Here's an overview on some of the features that our portfolio tracking tool offer you:

Tracking Stake on many Validators

You can track the performance of different validators including their uptime, commission rates, and slashing history. You are allowed to view and manage the amount of crypto you have staked with each validator. This will help you understand how your stakes are diversified across validators and ultimately minimize your risks.

Multi-Network Tracking

As users, you have access to a single dashboard where they can view their staking positions across all these different networks. You have real-time updates on the status of the blockchain network and validators.

Staking cryptocurrencies across multiple validators and networks has become a sophisticated strategy for those looking to maximize returns and distribute risks. A state-of-the-art tracking system like ours is designed for this purpose, seamlessly integrating various features to provide a holistic view and management platform.

Transaction Tracking per Validator

Another cool feature is that you have records of when and how much was staked or unstaked with each validator. You can track your staking rewards collected over time, including automatic alerts on APY and commissions. Our tracking tool offers real-time monitoring capabilities that allow you to keep an eye on multiple staking transactions with different validators across various blockchains.

Understanding the Importance of a Cryptocurrency Portfolio

A cryptocurrency portfolio represents a collection of various digital assets held by an investor. Much like a traditional investment portfolio, which might consist of stocks, bonds, and real estate, a cryptocurrency portfolio can include a mix of Bitcoin, Ethereum, altcoins, and perhaps even tokenized assets.

Why Diversify?

- Risk Management: Cryptocurrencies are notorious for their volatility. A diversified portfolio can mitigate the potential downside of any single asset's poor performance.

- Potential for Varied Returns: Different cryptocurrencies have different risk-reward profiles. While some might offer stable growth, others can provide the possibility of explosive returns.

- Exposure to a Spectrum of Use-Cases: The crypto world is vast. From decentralized finance (DeFi) platforms to non-fungible tokens (NFTs) to smart contract systems, there's a universe of possibilities. A diverse portfolio lets you tap into these varied sectors.

Regularly Review and Rebalance

The crypto landscape can change rapidly. Regularly reviewing your holdings ensures they align with your investment goals. If one asset outperforms others, consider rebalancing to maintain your desired asset allocation.

🔐Safety first! Regardless of how diversified your portfolio is, ensure your investments are secure. Use reputable wallets, employ two-factor authentication, and consider using hardware wallets for significant amounts.

In Conclusion

While the potential rewards are significant, remember that all investments come with risk. As the adage goes, "Never invest money that you can't afford to lose". Equip yourself with knowledge, stay updated, and embark on this fascinating journey through the crypto universe!

Disclaimer: Cryptocurrency investments are speculative and involve risks. This article is for informational purposes only and should not be considered financial advice. Always conduct your own research before making decisions.